If you’re tired of juggling spreadsheets and trying to make sense of your monthly spending — welcome to the future. In 2025, AI budgeting tools are changing how we manage money. These smart financial assistants not only track your spending but also give you actionable insights, personalized saving tips, and automation that actually works.

In this post, we’ll break down the top 7 AI budgeting tools you need to try in 2025. Whether you’re a beginner or a budget pro, there’s something here that will make your financial life easier — and maybe even fun.

What Are AI Budgeting Tools?

AI budgeting tools use artificial intelligence to help you manage your finances more efficiently. Instead of manual inputs and rigid categories, these apps learn from your behavior, identify trends, and recommend smarter ways to save, budget, and spend.

Mini Definition: AI Budgeting Tool

A software or app that uses artificial intelligence to automate and personalize your financial planning, budgeting, and saving processes.

Why Use AI for Budgeting in 2025?

Here’s why millions of users in the US, UK, Canada, and Australia are switching to AI-based money apps:

- Real-time financial tracking

- Automated savings based on spending behavior

- Personalized recommendations

- Smart alerts & subscription tracking

- Better than Excel or old-school budgeting apps

Let’s now jump into the top 7 AI budgeting tools that are leading the way.

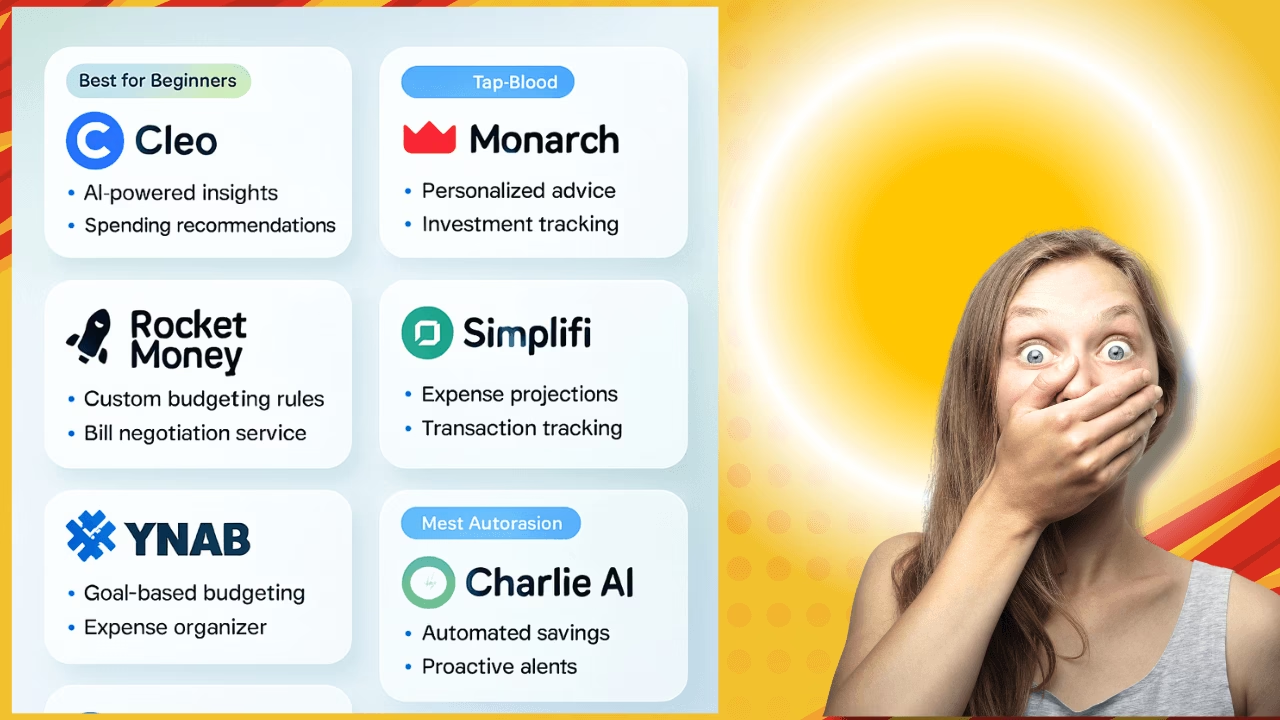

Top 7 AI Budgeting Tools You Should Try in 2025

1. Cleo

- Best For: Gen Z & Millennials

- AI Feature: Chat-based budgeting assistant with humor and real savings challenges

- Why Try It: It’s like having a sassy money coach in your pocket. Cleo roasts your spending habits and helps you build healthy money routines with fun.

- Website: meetcleo.com

2. Rocket Money (formerly Truebill)

- Best For: Subscription tracking and bill negotiation

- AI Feature: Detects recurring charges, negotiates lower bills

- Why Try It: This AI budgeting tool cancels unwanted subscriptions automatically and finds ways to lower your bills.

- Website: rocketmoney.com

3. Copilot Money

- Best For: Apple users & professionals

- AI Feature: Auto-categorizes spending and gives personalized insights

- Why Try It: Great UI, seamless syncing with iOS and bank accounts. You get smart monthly summaries and trend analysis.

- Website: copilot.money

4. YNAB (You Need A Budget)

- Best For: Detailed budget planning

- AI Feature: Uses behavior modeling to help you assign every dollar a job

- Why Try It: Proven method for debt reduction and savings. AI helps you adjust your plan dynamically.

- Website: ynab.com

5. Monarch Money

- Best For: Families & long-term planning

- AI Feature: Shared budgets, goals, real-time financial overview

- Why Try It: AI lets you plan jointly with your partner or family. Great for serious planners.

- Website: monarchmoney.com

6. Simplifi by Quicken

- Best For: Simplicity & automation

- AI Feature: Predicts cash flow, tracks goals automatically

- Why Try It: Built by the trusted team at Quicken but made for 2025. Clean design, solid automation.

- Website: quicken.com/simplifi

7. Charlie AI

- Best For: Beginners who need a coach

- AI Feature: Chatbot-style experience with daily financial check-ins

- Why Try It: Great for people who hate spreadsheets. Charlie texts you reminders, goals, and tips in plain English.

- Website: hicCharlie.com

How to Choose the Right AI Budget App

Ask yourself:

- Do I want a chatbot or a dashboard experience?

- Do I need to share this budget with a partner?

- Do I care more about saving money or understanding my expenses?

👉 For a playful experience: Go with Cleo or Charlie 👉 For serious planning: Try YNAB or Monarch 👉 For effortless automation: Try Copilot or Simplifi

FAQ – People Also Ask

What is the best AI budgeting app in 2025?

Cleo, Rocket Money, and Monarch Money are among the top-rated AI budgeting apps in 2025, depending on your goals.

Are AI budgeting tools safe?

Yes, most tools use bank-level encryption and comply with data protection laws like GDPR or CCPA.

Can AI really help me save money?

Absolutely. AI budgeting tools analyze your spending patterns and automate savings where possible — often saving users hundreds each year.

Are there free AI budgeting tools?

Yes, apps like Cleo and Charlie AI have strong free versions with optional upgrades.

How do I start using an AI budget tool?

Download your chosen app, link your bank account, set a goal, and let the AI guide you.

Final Thoughts

Let’s be real — traditional budgeting apps are outdated. If you’re serious about saving money in 2025, you need tools that work with you, not against you.

These top 7 AI budgeting tools offer automation, insights, and convenience that make budgeting not just easy — but enjoyable. Test out 2 or 3 and stick with the one that fits your lifestyle.

✅ Ready to take control of your money? 👉 Try one of these AI budgeting tools today — and let AI do the hard work for you.

🔗 Explore more smart money tools on AI Budgetify’s homepage