The field workplace is not what it was once, and everybody needs to know why. The pandemic is the reply that is best to succeed in for, however that was extra like a catalyst than a trigger, accelerating what was already in movement. The business has spent the years since 2020 ready for a field workplace restoration that’s more and more wanting prefer it’ll by no means come – or a minimum of not anytime quickly. Theaters must deal with a market that is a couple of billion {dollars} lighter than it was on the finish of the 2010s for the foreseeable future.

One thing usually cited as a principal issue on this decline is the erosion of the theatrical exclusivity window. Previously, new-release films had a transparent life cycle, spending a sure period of time in cinemas earlier than changing into accessible for at-home viewing usually months later. The arrival of streaming and VOD was already altering that calculus, however when the pandemic immediately robbed theaters of their leverage, the norms crumbled. Now, 90 days is a rarity, and loads of movies go in lower than 30.

This follow, many have argued, is what’s hurting the flicks. On the cultural stage, that is fairly simple. The moviegoing viewers has discovered that no matter flashy new movie they hear about can be accessible at house in a matter of weeks, and lots of now not really feel the necessity to depart the home for one anymore.

However this identical argument pops up anytime a film fails to fulfill field workplace expectations, and I have been rather more skeptical of its utility there. The theatrical paradigm has shifted, however that is true whether or not studios proceed to gas it or not. Can a shortened theatrical window actually be blamed for a person movie’s efficiency?

I requested Cinelytic, which (amongst different issues) makes use of its AI-powered, filmmaker-targeted instruments to forecast the field workplace with exceptional accuracy, to look into it for me – and the ensuing information inform an fascinating story.

A Quick Window Would not Make A Film’s Field Workplace Expectations Unreachable

Increasing on Cinelytic’s October 2025 insights, the next desk breaks down the home field workplace efficiency of 30 theatrical movies from this yr into three efficiency classes, based mostly on how business specialists and analysts anticipated them to do (not, I ought to make clear, essentially what they may’ve wanted to interrupt even): Underperformer; On Goal; and Overperformer. They’re sorted by the size of their theatrical window, which ranges from Mission: Not possible – The Ultimate Recknoning‘s 88 days to a smattering of movies at simply 18.

|

Title |

Theatrical Window (Days) |

Home Field Workplace |

Estimated Vary |

Class |

|---|---|---|---|---|

|

Mission: Not possible – The Ultimate Reckoning |

88 |

$197,413,515 |

$180 – $260M |

On Goal |

|

Elio |

60 |

$72,987,454 |

$90 – $120M |

Underperformer |

|

Captain America: Courageous New World |

60 |

$200,500,001 |

$230 – $320M |

Underperformer |

|

Lilo & Sew |

60 |

$423,778,855 |

$150 – $250M |

Overperformer |

|

The Improbable 4: First Steps |

60 |

$274,286,610 |

$250 – $340M |

On Goal |

|

F1 |

56 |

$189,527,111 |

$100 – $150M |

Overperformer |

|

Snow White |

53 |

$87,203,963 |

$130 – $200M |

Underperformer |

|

Sinners |

45 |

$278,578,513 |

$80 – $130M |

Overperformer |

|

The Monkey |

42 |

$39,724,909 |

$35 – $60M |

On Goal |

|

28 Years Later |

39 |

$70,446,897 |

$70 – $100M |

On Goal |

|

A Minecraft Film |

39 |

$423,949,195 |

$300 – $450M |

On Goal |

|

Superman |

35 |

$354,184,465 |

$340 – $480M |

On Goal |

|

Jurassic World Rebirth |

34 |

$339,640,400 |

$300 – $450M |

On Goal |

|

Tips on how to Prepare Your Dragon |

32 |

$262,958,100 |

$240 – $350M |

On Goal |

|

Weapons |

32 |

$151,525,978 |

$75 – $100M |

Overperformer |

|

Mickey 17 |

32 |

$46,047,147 |

$35 – $70M |

On Goal |

|

The Conjuring: Final Rites |

32 |

$176,992,530 |

$90 – $150M |

Overperformer |

|

Certainly one of Them Days |

25 |

$50,054,690 |

$40 – $70M |

On Goal |

|

Novocaine |

25 |

$19,861,854 |

$12 – $25M |

On Goal |

|

Smurfs |

25 |

$31,075,170 |

$45 – $70M |

Underperformer |

|

Warfare |

25 |

$26,000,309 |

$20 – $40M |

On Goal |

|

Flight Threat |

21 |

$29,783,527 |

$25 – $45M |

On Goal |

|

The Alto Knights |

21 |

$6,103,664 |

$8 – $20M |

Underperformer |

|

M3GAN 2.0 |

18 |

$24,101,280 |

$50 – $65M |

Underperformer |

|

Den of Thieves 2: Pantera |

18 |

$36,015,016 |

$30 -$55M |

On Goal |

|

Wolf Man |

18 |

$20,707,280 |

$25 – $45M |

Underperformer |

|

Canine Man |

18 |

$97,970,355 |

$80 – $130M |

On Goal |

|

Companion |

18 |

$20,809,101 |

$18 – $35M |

On Goal |

|

Black Bag |

18 |

$21,474,035 |

$18 – $35M |

On Goal |

|

A Working Man |

18 |

$37,000,711 |

$25 – $45M |

On Goal |

On this pattern, there have been seven Underperformers, 18 On Targets, and simply 5 Overperformers. At first look, there appears to be one thing to this windowing argument – of the 13 movies with home windows of 25 days or much less, none overperformed. However the vast majority of this bracket nonetheless landed within the predicted field workplace vary, even with the short VOD releases, and Underperformers are additionally discovered amongst films with home windows on the prime finish, over 45 days.

In reality, it is the 26-45 days vary that has the perfect outcomes. All ten of these movies both met their anticipated goal or got here in above it.

Evaluation of this sort is not new – and it is dangerous to learn an excessive amount of into it. VOD launch dates will be reactive, that means that distributors could adapt their technique to how their movie is definitely doing. It is not too stunning to see Underperformers concentrated on the poles, for instance. Getting a film to digital extra shortly is a technique to answer early field workplace struggles; attempting to maintain it unique to theaters so long as potential is one other.

So, this does not inform us if an underperforming movie’s theatrical window, whether or not lengthy or quick, is responsible for its field workplace efficiency. But when a film is not getting seen in theaters as a result of persons are ready for it to turn out to be accessible at house, that may present within the subsequent streaming numbers.

Streaming Efficiency Is The place The Windowing Argument Falls Aside

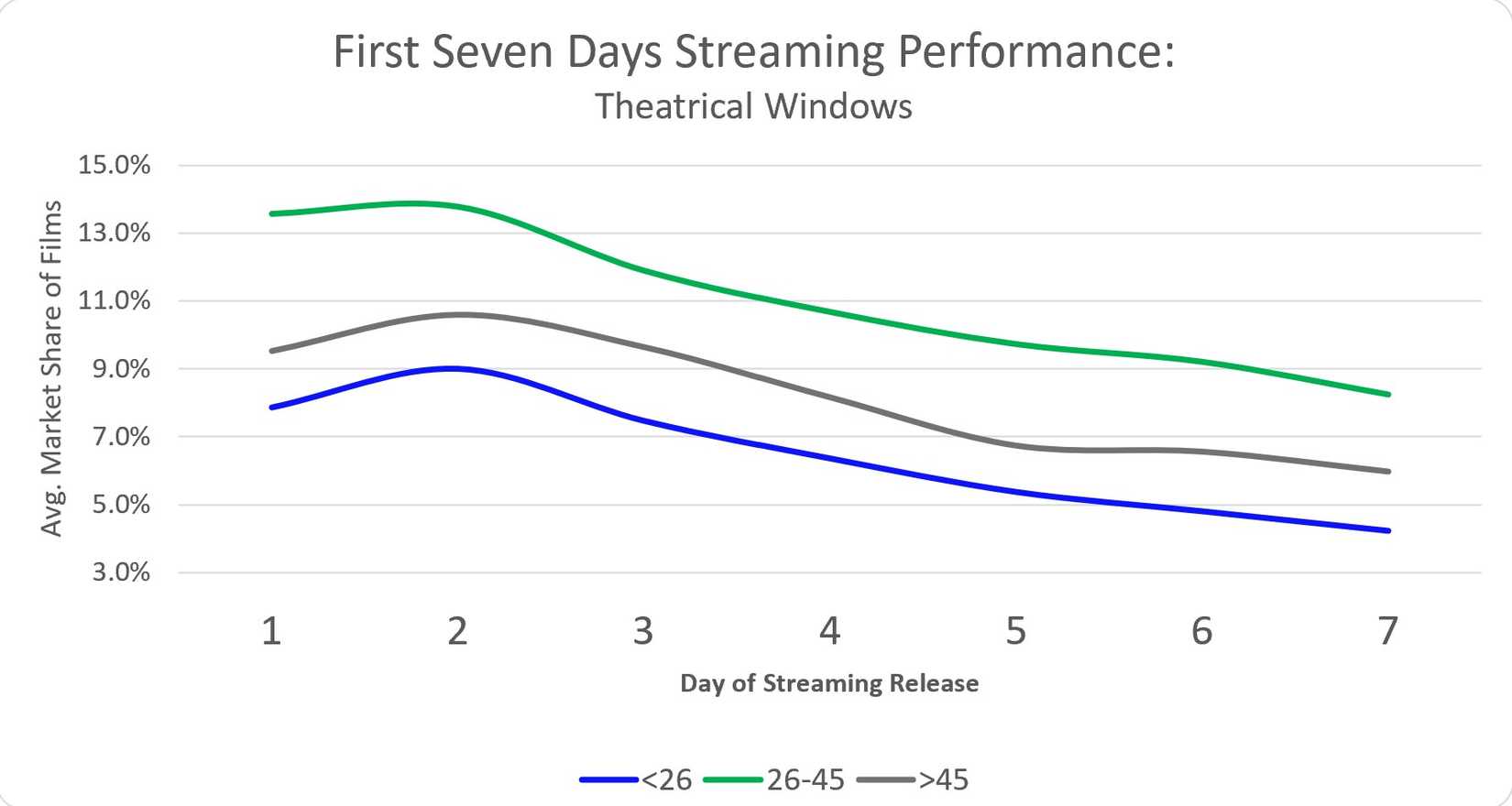

The chart above teams the 30 movies into these three tiers of theatrical window size and charts their proportion of market share over their first seven days of streaming availability. 26-45 days, the mid-range that obtained the perfect monetary outcomes, is once more the winner right here. Movies with home windows of 25 days or much less carried out the worst on streaming, whereas these with the longest home windows have been solely a contact higher.

So, studios aren’t essentially seeing the viewership advantage of a fast VOD launch, nor does holding a movie in theaters longer improve the at-home demand. A murky contradiction, for the needs of this evaluation. But it surely will get slightly clearer when returning to the field workplace lens:

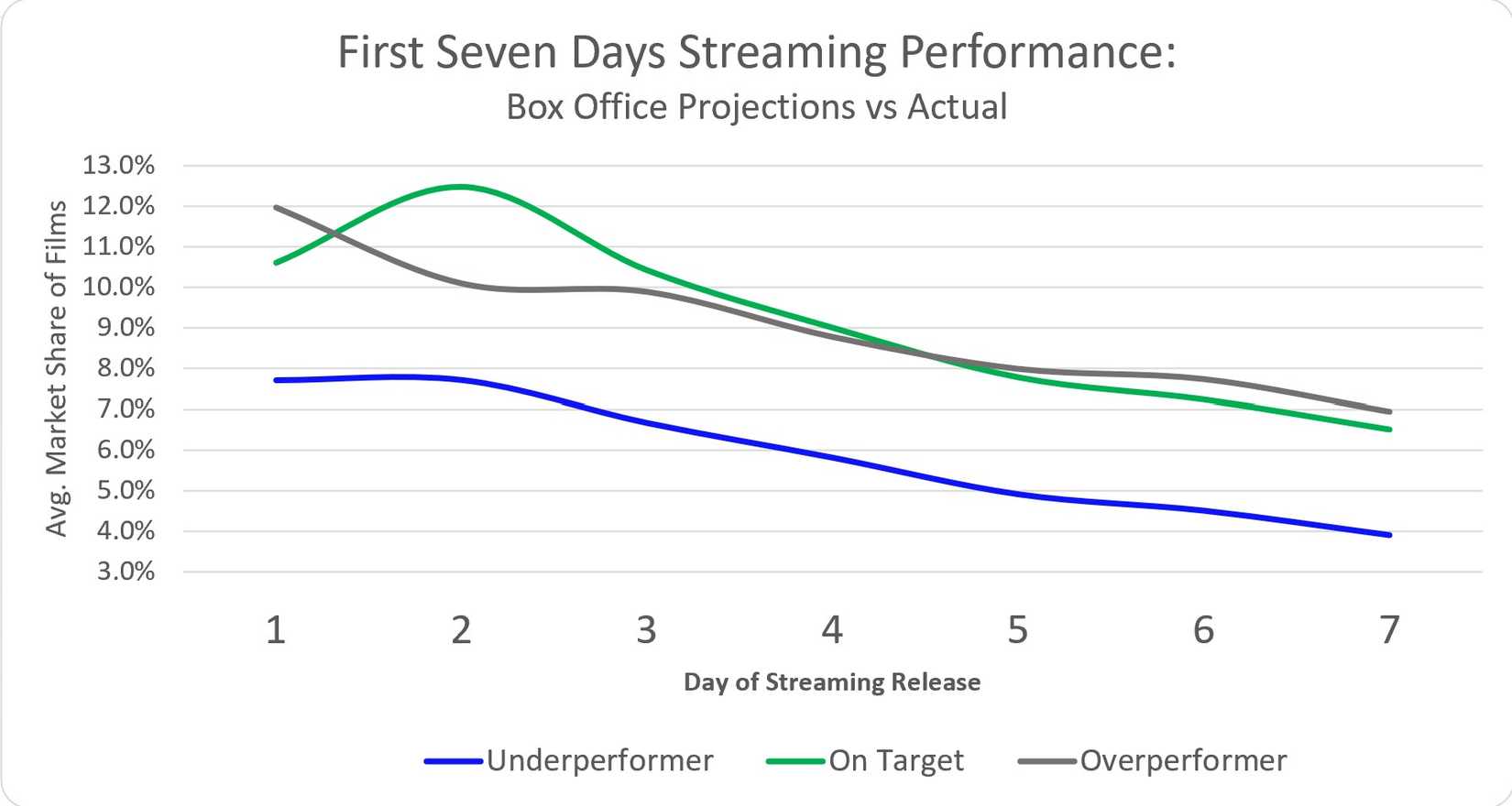

It is within the above chart, which appears to be like on the identical streaming market share however organizes the flicks by their field workplace efficiency classes, that we see the reality about windowing. Each the Overperformers and the On Targets sport comparable values, although the latter group tends to spike on day 2 of digital availability. That bump represents the individuals who noticed the film’s advertising and marketing, have been , however most popular to attend till they may watch it from the consolation of their lounge.

If the “quick windowing hurts field workplace” argument is right, the Underperformers are the place we must always see that development, since these are the movies folks supposedly skipped in theaters to look at at house later. As an alternative, this class noticed no such spike, and carried out rather more poorly general than the theatrically profitable movies.

Whereas adjustments within the business’s windowing follow have absolutely impacted folks’s relationship with the flicks, blaming them for a person movie’s efficiency is a step too far. If one thing underperforms on the field workplace and on digital, audiences simply have little interest in seeing it, in any setting.

Distributors and exhibitors dealing with that situation would profit from digging deeper into why that is likely to be, quite than speeding responsible the standard suspect.