The relationship app sport is brutal. You swipe left, swipe proper, repeat till your thumb goes numb. You commerce infinite small-talk messages making an attempt to show you are sane, fascinating, and value assembly in individual. In the event you’re fortunate, you discover somebody nice and get to journey the euphoric excessive of a brand new relationship. In the event you’re not, issues fizzle, implode, or finish in a spectacularly painful breakup.

Because it seems, being a publicly traded dating-app firm is not all that completely different.

Not that way back, Bumble was one of many hottest and most enjoyable pre-IPO corporations on the planet. The feminine-first platform was based in 2014 by former Tinder govt Whitney Wolfe Herd. Whitney had famously been pushed out of Tinder. Sexual harassment allegations have been filed. Tinder executives tried to erase her as a co-founder. And with a comparatively small settlement in hand, Whitney struck out on her personal and launched a brand new, higher, cooler, female-empowerment-driven relationship app. Within the course of, she made Tinder appear like the outdated, busted platform nobody needed to be on.

In February 2021, Bumble soared in its IPO debut, minting Whitney because the youngest self-made feminine billionaire on the earth. After which… identical to an important relationship gone sideways… Bumble stumbled.

Vivien Killilea/Getty Photographs

The Rise

Bumble did not simply arrive — it detonated onto the scene. From day one, Whitney Wolfe Herd positioned the app because the antithesis of Tinder: a spot the place girls managed the dialog, the place poisonous habits wasn’t tolerated, and the place relationship did not really feel like a digital bar struggle. The pitch was easy and sensible. In heterosexual matches, solely girls may ship the primary message. In same-sex matches, both individual may provoke. It was a small product tweak that solved a large emotional ache level, and it instantly set Bumble aside in a panorama dominated by Tinder, Hinge, and a thousand forgettable clones.

By late 2015, Bumble had logged 80 million matches and was spreading throughout school campuses, workplace parks, and main cities with wildfire velocity. What most customers did not understand was that the app wasn’t an impartial startup in any respect — it was technically a subsidiary of Russian mogul Andrey Andreev’s relationship empire. Wolfe Herd owned roughly 20% of the enterprise in its early construction, Andreev owned about 80%, and Bumble was powered by Badoo’s engineering infrastructure in London. The weird company association meant Whitney did not really management her personal firm within the early years, nevertheless it additionally meant she had entry to capital, engineering expertise, and user-acquisition firepower that almost all founders may solely dream of.

The expansion was staggering. By 2017, Bumble had over 22 million customers. By 2019, the quantity had handed 100 million. That very same yr, Blackstone acquired Andreev’s stake in a deal valuing Bumble’s guardian firm at $3 billion. The deal eliminated Andreev, reorganized the board, put in Wolfe Herd as CEO, and gave her a life-changing liquidity occasion: a $125 million payout, plus a mortgage to her holding firm that she later repaid. For the primary time, Whitney actually managed Bumble.

With a clear cap desk, a brand new governance construction, explosive person progress, and a model that dominated the cultural dialog, Bumble made its transfer. In early 2021, Whitney took the corporate public. Bumble priced its IPO at $43 per share, opened at $76, and briefly flirted with $84. The market cap surged to roughly $8–9 billion, immediately minting Wolfe Herd because the youngest self-made feminine billionaire in historical past. Traders have been euphoric. Analysts have been glowing. The media handled Bumble like the brand new gold commonplace for female-led tech.

For a quick, dazzling second, Bumble was the way forward for on-line relationship — a $9 billion rocket ship, fueled by cultural relevance, investor urge for food, and a founder whose story was irresistible.

Bryan Bedder/Getty Photographs

The Fall

The difficulty began virtually instantly. After the euphoric IPO spike, Bumble’s inventory settled into a protracted, grinding descent that no quantity of optimistic press releases or product updates may reverse. By the tip of 2021 — barely ten months after Whitney Wolfe Herd turned a billionaire — the share worth had fallen sufficient to wipe out her billionaire standing. Wall Road’s early pleasure a few female-first relationship revolution light quick as soon as buyers dug into the numbers: person progress was slowing, engagement had cooled, and Bumble’s enlargement into friendship (BFF) and networking (Bizz) wasn’t producing significant income.

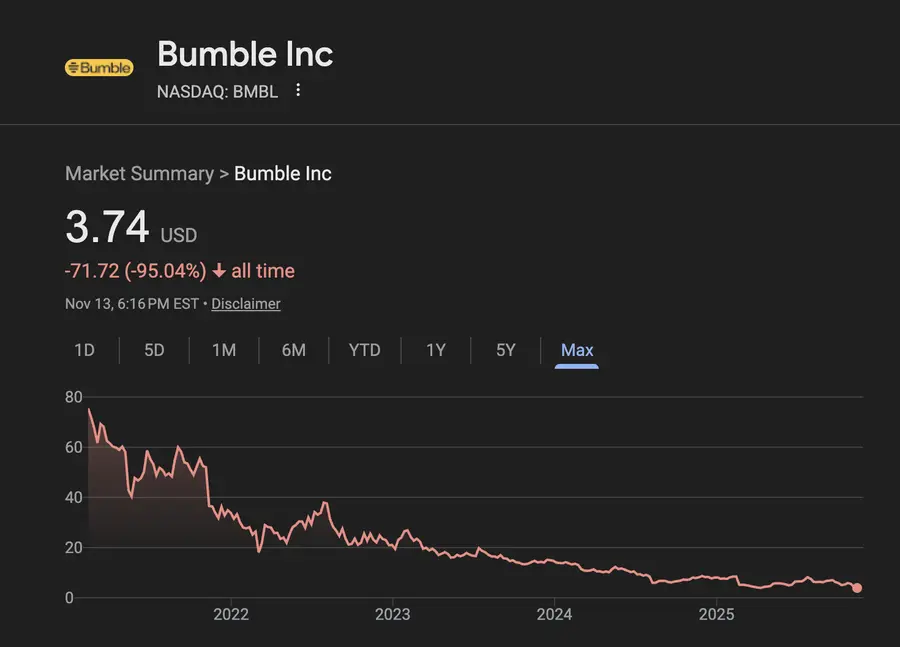

Then got here 2022. And 2023. And 2024. Annually introduced a brand new spherical of disappointing steerage, weaker-than-expected earnings, and intensifying competitors from Tinder, Hinge, and an explosion of area of interest relationship apps. Here is a chart of how Bumble’s inventory has carried out since going public in early 2021. Be aware the purple “all time quantity”:

95% Drop

Whitney Wolfe Herd was a paper billionaire for under about ten months — from February 2021 to November 2021. On the time of the IPO, she owned a little bit over 11% of the corporate, a stake value greater than $1.5 billion at its peak. Right this moment, in keeping with Bumble’s newest SEC filings, Whitney owns roughly 1.5% of Bumble, or about 1.7 million shares. On the present inventory worth, that stake is value roughly $6 million.

Nevertheless, that quantity does not symbolize the total worth she has realized. Wolfe Herd cashed out significant sums alongside the best way.

Along with her one-time $125 million pre-IPO windfall from the 2019–2020 Blackstone acquisition and restructuring, Whitney has offered no less than $50 million value of Bumble shares because the firm went public. That features:

- $40+ million from a 2023 secondary providing tied to Blackstone’s sell-down

- $8.5 million from her 2025 open-market sale

- Plus a number of smaller disposals to cowl RSU tax obligations

The place Whitney and Bumble Are Right this moment

Whitney stepped down as CEO in 2024, moved into an executive-chair function, after which returned to the CEO seat in 2025 to assist regular the enterprise. Bumble nonetheless has hundreds of thousands of customers and robust model recognition, nevertheless it now operates in a much more aggressive, slower-growth panorama.

Whitney is much from being a billionaire. Right this moment, we estimate her web value at round $100 million.

She and her husband, Texas oil inheritor Michael Herd, have channeled a few of that wealth into high-end actual property, together with a 6.5-acre Lake Austin compound, which was briefly listed in 2020 for $28.5 million, and a historic Montecito property, which they purchased from Ellen DeGeneres for $21 million and offered in 2025 for $22.8 million.

At house, Wolfe Herd leads a quiet household life centered round Austin, the place she and Michael are elevating their younger son. Whether or not Bumble can mount a second act — and whether or not Whitney can rebuild something near her former billionaire-level paper fortune — stays to be seen. For now, Wall Road is swiping left arduous.