Let’s faux you one way or the other managed to invent a time machine… out of a DeLorean… What’s the very first thing you’d do? Or, extra particularly, what is the first cut-off date you’d journey again to?

Positive, you can use the time machine to witness some pivotal historic second, just like the signing of the Declaration of Independence or the assassination of JFK. However let’s be trustworthy. For those who’re a CelebrityNetWorth reader, you’d use the time machine to set your self up for unimaginable wealth. Simply ask Hill Valley’s wealthiest resident and luckiest sports activities gambler, Biff Tannen.

I do know what you are already considering. For those who had a time machine and a few hundred {dollars}, you’d solely want to return a decade and purchase some Bitcoin to make your future self insanely wealthy. Truthful sufficient. However to illustrate your time machine had one quirky wrinkle: It has to journey again not less than 100 years.

With that wrinkle in thoughts, at what level from earlier than 1925 would you journey again to, and what would you purchase?

The reply is not so simple as you may suppose. For instance, if you happen to plan to return 300 years and purchase all of the land that turned Malibu, first off, what would you employ to purchase the land? Trendy forex would not work. You’d want one thing you can commerce, like a diamond or some gold. And what would all of Malibu price tons of of years in the past? Do you presently personal one thing that might be traded for the suitable amount of cash tons of of years in the past? And to illustrate you do handle to purchase all of Malibu, how are you going to guard your land from invaders/squatters over the centuries earlier than you’re born???

See? It is not really easy! No matter you purchase must be:

- Simple for anybody to purchase anonymously (to not set off any alarms sooner or later)

- Comparatively low-cost

- Simply tracked and defensible over the following century

- One thing that turns into a fully huge fortune not just for your self, however your youngsters, grandkids, and great-grandkids

With these guidelines in thoughts, the inventory market is a very secure system for this problem. It satisfies the entire above guidelines. So, if you happen to traveled again 100 years in the past with one thing that might be traded for a pair hundred {dollars}, what inventory would you purchase?

I even have the reply. It is Coke. For those who purchased only one share of Coca-Cola—and even higher, 100 shares- on the firm’s 1919 IPO, immediately you’d be an absurdly rich 106-year-old. Particularly if you happen to reinvested your dividends alongside the way in which…

Lady Dishing out Coke At Soda Fountain (1927 through Getty)

A Very Temporary Historical past of Coca-Cola: From Cocaine to IPO

Coca-Cola’s origins return to at least one man: John “Doc” Pemberton, a Georgia pharmacist and wounded Civil Warfare veteran. After struggling a brutal sword damage and falling right into a lifelong morphine dependancy, Pemberton started experimenting with different ache cures. His first concoctions have been flops (one early syrup induced vomiting and paralysis), however inspiration struck when he heard about Europe’s widespread cocaine-and-wine tonic, Vin Mariani. Pemberton whipped up his personal model, mixing coca leaves, wine, and kola nut extract. He referred to as it “French Wine Coca.”

When Atlanta handed temperance legal guidelines banning alcohol in 1885, Pemberton reworked the recipe by swapping wine for sugary syrup and carbonated water. His bookkeeper, Frank Robinson, prompt the identify “Coca-Cola” and even hand-drew the now-iconic script emblem. The drink shortly caught on in native pharmacies, although Pemberton himself by no means noticed the monetary rewards. Addicted, sick, and practically broke, he bought his stake to fellow pharmacist Asa Candler, who quickly gained full management of the system.

Candler proved to be a far sharper businessman. He aggressively marketed Coca-Cola, launched a franchise bottling system, and scaled the drink right into a nationwide sensation. He additionally eliminated the cocaine in 1903 (sure, it actually was in there). By the point he stepped away from the corporate in 1916, Coca-Cola had change into one in every of America’s most beloved manufacturers. Three years later, in 1919, Candler’s kids bought the enterprise for $25 million to a gaggle of traders led by Ernest Woodruff, who promptly took it public at $40 per share.

And that is the second our time-traveling experiment is occupied with: the Coca-Cola IPO. As a result of if you happen to’d been standing on the ground of the New York Inventory Trade on September 5, 1919, with simply $40 in your pocket, the fortune you can have set in movement would make even Biff Tannen jealous…

100 Shares Purchased At IPO: With A Dividend Twist

As you understand, within the century after the IPO, Coca-Cola turned one of the crucial iconic manufacturers and widespread drinks in historical past. Individuals purchased Coke in the course of the Roaring Twenties, they purchased it via the Nice Despair, they usually purchased it via each warfare, recession, and cultural shift that adopted. That reliability was a century-long money-printing machine for anybody fortunate sufficient to personal inventory.

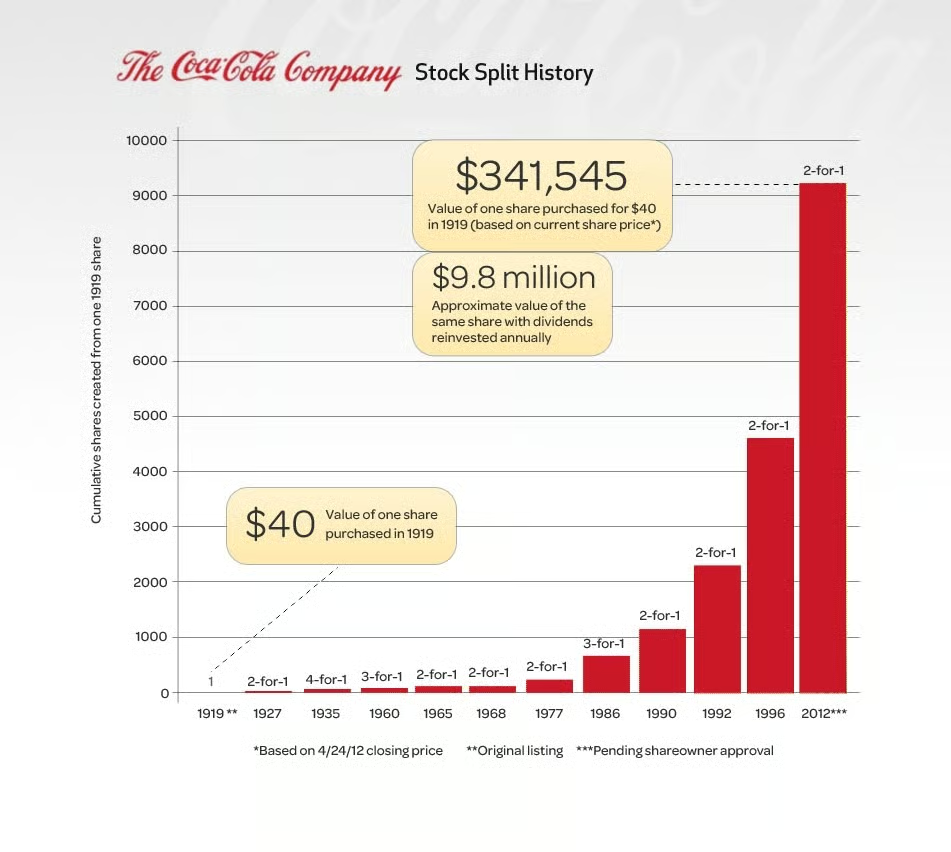

On the IPO in September 1919, one share price $40. Over the following century, Coke would go on to separate its inventory a number of occasions, in order that single share did not keep a single share for lengthy. In truth, because of 11 inventory splits, one $40 share from 1919 would ultimately blossom into 9,216 shares immediately. At Coca-Cola’s present worth of about $69, that pile of inventory alone can be price over $635,000.

However wait a minute. $635,000 is not precisely a life-changing, generational-wealth, Scrooge McDuck-sized fortune… What are we doing right here? Effectively, there is a twist. A dividend twist.

Coke has paid good-looking dividends over the past century. For instance, in 2024, Coke paid shareholders $1.94 per share in annual dividends. So if you happen to have been sitting on 9,216 shares from that authentic $40 funding, final yr you acquired round $18,000.

A lot of individuals simply take these dividends and use them as earnings. However there’s another choice. You may take these dividend funds and robotically purchase extra shares. For those who did that with $18,000 in 2024, you’d have added round 200 extra shares to your pile. Try this not as soon as, however with each single dividend fee for greater than a century, and the mathematics can explode. Every new share earns its personal dividend, which buys extra shares, which pay much more dividends… a monetary snowball rolling downhill for over 100 years.

The Dividend Snowball

Usually, it could be a reasonably huge process to calculate the current worth of a single share after a century of dividend reinvestments. Even AI would most likely mess up the mathematics or not have the total 100+ years of information. Fortunately, in 2012, Coke’s investor relations group did the grueling work to calculate the worth of 1 share (with dividend reinvestment) as much as that time. Under is the chart they put collectively. As you possibly can see, as of 2012, a single share of Coke purchased for $40 on the 1919 IPO had change into $341,545 with out dividend reinvestment. With dividend reinvestment, that $40 share had change into $9.8 million. And that is via 2012! We simply up to date the mathematics…

The Up to date Math

We simply spent an hour updating the mathematics via the tip of 2024. Backside line, as we talked about already, a single share purchased on the IPO with out dividend reinvestment can be $635,000 immediately. With dividend reinvestment, via 2012, your single share is price $9.8 million. By the tip of 2024? $25 million.

And let’s crank up the time machine dial. As an alternative of shopping for only one share on the IPO, to illustrate you went all in and purchased 100 shares at $40 apiece. That will have price you $4,000 in 1919. In immediately’s cash, that is about $75,000 after adjusting for inflation. Not a small sum, however not completely not possible both. In truth, if you happen to one way or the other traveled again with one fashionable diamond and/or a bag of gold cash, you need to have the ability to commerce for $4,000 money in 1919 and snap up your stake in Coca-Cola.

So what did that $4,000 purchase? Because of 11 inventory splits, these 100 shares would have multiplied into 921,600 shares immediately. These shares would spin off greater than $1.7 million yearly in dividends alone. With dividend reinvestment, immediately you’d be sitting on $2.5 billion. All from a $4,000 wager made in 1919 🙂

Now, if you happen to’ll excuse me, I have to tinker with the flux capacitor in my DeLorean.