Earlier than we even get began, let me clearly state that every thing you might be about to learn is predicated on allegations and reporting revealed by Enterprise Insider (BI) in a latest article titled “Cash to Blow Inside Floyd ‘Cash’ Mayweather’s lavish, debt-filled post-boxing life.”

In response to Enterprise Insider’s reporting, Mayweather’s legal professional, Bobby Samini, pushed again strongly towards the general narrative, denying that Mayweather is “experiencing monetary pressure.” Samini supplied the next assertion to BI:

“Floyd Mayweather rose from poverty and hardship to grow to be one of many biggest champions in boxing historical past, reworking his expertise and self-discipline into an undefeated legacy and a extremely profitable enterprise empire. Creating unfounded narratives misrepresents the reality and minimizes the achievements of a person who has risen from adversity to grow to be one of the vital profitable athletes and entrepreneurs of his era.“

It must also be famous that Floyd is at the moment suing Enterprise Insider and one of many reporters, Daniel Geiger (one of many authors of this newest article), for defamation over earlier protection of a industrial actual property funding made by Mayweather. In his $100 million lawsuit towards the outlet and its reporter, Floyd claims: “Daniel Geiger refused a number of invites to assessment verified transaction data and documentation that might have confirmed the offers had been executed as described.” Mayweather’s workforce additionally argued that the reporting was not simply inaccurate however racially motivated, claiming Geiger made disparaging feedback suggesting Floyd was “unqualified” to personal such belongings.

With these disclaimers firmly in place, Enterprise Insider not too long ago revealed a prolonged, eyebrow-raising investigation inspecting Floyd Mayweather’s monetary life after boxing. In line with the report, the authors reviewed public data, mortgage paperwork, lawsuits, and carried out interviews with present and former associates to color a much more difficult image of the person lengthy generally known as “Cash” Mayweather.

The article focuses on how his immense fortune has been managed in retirement, highlighting heavy borrowing towards actual property, disputed enterprise claims, alleged foreclosures, liens, lawsuits, and an rising reliance on leverage and exhibition fights to maintain a very costly way of life.

(Ethan Miller/Getty Photos)

One Of The Highest Paid Athletes In Historical past

Let’s begin with a few indeniable information:

- Floyd is a particularly shrewd businessman.

- Floyd has earned at the least $1.1 billion throughout his profession.

The overwhelming majority of boxers who got here earlier than Floyd weren’t far more than extremely paid staff of promoters. They acquired set charges for exhibiting up and combating, however they didn’t take part meaningfully within the monumental earnings generated by pay-per-view, ticket gross sales, and occasion promotion. For the primary decade of his profession, Floyd was no completely different. He fought underneath Bob Arum’s High Rank promotions and picked up assured purses.

As much as that time, Floyd’s profession already seemed like a textbook success story. He was undefeated, a multi-division world champion, and extensively thought to be probably the greatest pound-for-pound fighters within the sport. But after practically ten years as an expert, his complete profession earnings had been nonetheless underneath $10 million.

In April 2006, Bob Arum provided Floyd $8 million to combat Antonio Margarito, a large leap from something Floyd had earned beforehand. As a substitute of accepting and remaining a extremely paid worker, Floyd selected to grow to be an proprietor.

In a particularly dangerous transfer, Floyd paid $750,000 to purchase himself out of his High Rank contract. As we wish to say round right here at Celeb Web Price: If you happen to imagine in your self, BET ON YOURSELF.

After extricating himself from High Rank, Floyd successfully grew to become a self-financed unbiased promoter. For his subsequent fights, he fronted the cash for venues, manufacturing, concessions, advertising, and even his opponents’ assured purses. The chance was monumental. If a combat underperformed, Floyd would have been personally accountable for tens of millions in prices. The upside, nonetheless, was unprecedented: by financing the operation himself, Floyd positioned himself to seize the lion’s share of the earnings.

The gamble paid off spectacularly. As a substitute of capping his upside at tens of tens of millions per combat, Floyd entered an period the place particular person bouts routinely generated nine-figure paydays. He earned greater than $550 million from simply two fights alone:

- $250 million from his 2015 bout towards Manny Pacquiao

- $300 million from his 2017 combat towards Conor McGregor

Due to his $1.1 billion profession earnings, Floyd Mayweather is likely one of the highest-paid athletes in historical past. On the time of his retirement from skilled boxing, we estimated Floyd Mayweather’s internet value to be $400 million.

Getty Photos

Enterprise Insider’s Allegations About Floyd’s Publish-Boxing Funds

Floyd retired from skilled boxing following his August 2017 combat towards Conor McGregor, which capped his profession at 50–0. In line with Enterprise Insider, the very traits that after fueled Floyd’s success—complete management, aggressive risk-taking, and a willingness to entrance large sums of his personal cash—could have grow to be liabilities in retirement. The report argues that as an alternative of institutionalizing his fortune by conservative asset administration, Floyd more and more relied on leverage, optimistic dealmaking, and a loosely ruled internal circle as he expanded into actual property, model licensing, and exhibition bouts.

What follows is a breakdown of Enterprise Insider’s central claims: how Floyd’s actual property investments had been structured, why a number of high-profile offers at the moment are being questioned, how debt and litigation entered the image, and why critics quoted within the report say his post-boxing monetary life seems to be much more fragile than the picture he continues to venture publicly. Once more, these are allegations and interpretations drawn from public data and interviews cited by Enterprise Insider.

Actual Property: Possession Claims vs. Public Information

One of many central pillars of Enterprise Insider’s reporting issues Floyd Mayweather’s post-boxing actual property exercise, significantly claims he has made publicly about proudly owning giant portfolios of economic property. In line with Enterprise Insider, Mayweather repeatedly portrayed himself because the outright proprietor of high-value condo buildings and industrial belongings, particularly in New York Metropolis. Nonetheless, the outlet reported that it couldn’t find property data supporting a number of of these claims.

Enterprise Insider targeted closely on Mayweather’s statements about shopping for a 62-building Manhattan condo portfolio and later buying roughly $400 million value of rent-regulated condo buildings in Higher Manhattan. In line with the report, individuals with information of these transactions mentioned Mayweather’s monetary participation was nominal, short-lived, or finally absorbed by different companions. In a single extensively publicized deal, Enterprise Insider reported that Mayweather’s preliminary fairness funding was later worn out, leaving him with no possession stake when the portfolio was finally spun off right into a publicly traded entity.

Mayweather disputes this characterization and is at the moment suing Enterprise Insider and its reporter, Daniel Geiger, for defamation, searching for $100 million in damages, associated to earlier protection of economic actual property investments.

Borrowing and Leverage

One other main focus of the Enterprise Insider investigation is Mayweather’s elevated use of debt after retirement. In line with the report, Mayweather borrowed roughly $54 million over a roughly 12-month interval from billionaire specialty lender Don Hankey, at an rate of interest of round 9%, to “fund different ventures.”

Enterprise Insider reported that the loans had been secured utilizing a broad cross-collateralization construction that included 14 residential properties, Mayweather’s Las Vegas strip membership, and his personal jet. Specialists cited by Enterprise Insider famous that any such borrowing construction carries elevated threat as a result of a default may place a number of belongings in danger concurrently quite than one property at a time.

Mayweather’s legal professional instructed Enterprise Insider that borrowing towards appreciated belongings is a standard apply amongst rich people and denied that the loans point out monetary misery, describing Mayweather as an “ultimate shopper.”

YURI CORTEZ/AFP through Getty Photos

Foreclosures, Liens, and Unpaid Obligations

Enterprise Insider additionally detailed a collection of foreclosures, tax points, liens, and lawsuits that it says emerged in recent times. In line with the report, at the least two industrial properties related to Mayweather had been foreclosed upon inside an 18-month span. One other Las Vegas industrial constructing tied to Mayweather confronted foreclosures over roughly $52,000 in unpaid property taxes and penalties.

The article additional cited lawsuits and liens alleging unpaid payments for a spread of bills, together with aviation gasoline, plane upkeep, luxurious autos, jewellery, and municipal providers. Among the many particular figures cited by Enterprise Insider:

- A Texas aviation gasoline provider alleged $137,000 in unpaid jet gasoline payments.

- An FAA lien of roughly $358,000 was positioned on Mayweather’s plane for upkeep work earlier than later being eliminated.

- Clark County positioned a $568 lien on Mayweather’s Las Vegas mansion for unpaid trash assortment.

- A Nigerian media firm gained a judgment that has reportedly grown to just about $3 million with curiosity, stemming from an alleged failure to look at paid occasions.

Automobile Dealership Lawsuits

Floyd can be at the moment the plaintiff and defendant in lawsuits involving a luxurious automotive supplier in Las Vegas referred to as Vegas Auto Gallery.

In line with a lawsuit filed by Vegas Auto Gallery, again in July 2025, Floyd purchased 4 automobiles value $2.25 million by his LLC, Mayweather Promotions LLC. He apparently returned three of the automobiles. The automotive he saved was a Mercedes G-Class SUV that’s valued at $1.2 million. He allegedly agreed to pay for the automotive by September 1. He allegedly didn’t pay. Auto Gallery agreed to increase the deadline to September 18, however as soon as once more, he allegedly didn’t pay. Auto Gallery additionally claims that Mayweather then defamed the dealership over Instagram posts wherein he instructed his followers it “does unhealthy enterprise,” figuring out one of many sellers by title, who apparently acquired threats from Mayweather followers, which needed to be reported to the police.

Floyd filed his personal lawsuit towards the dealership, claiming it by no means supplied him with the mandatory documentation to title or register the G-Wagon in Nevada as promised.

Previous Tax Points and Liquidity Considerations

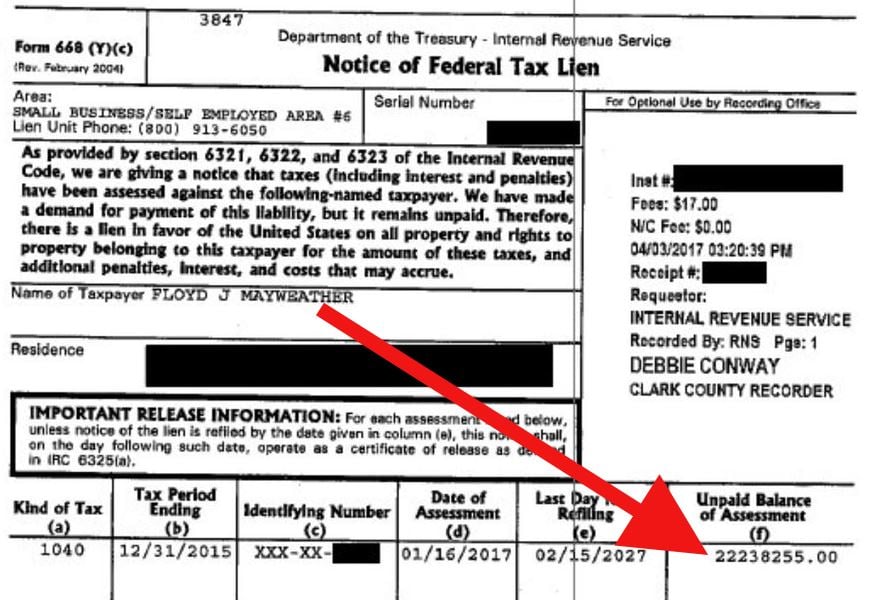

Again in March 2017, the IRS hit Floyd with a requirement for $22.2 million in again taxes associated to his 2015 earnings. Extra particularly, the IRS filed a “Discover of Federal Tax Lien” naming the taxpayer “Floyd J Mayweather” as having an “Unpaid Stability of Evaluation” of $22,238,255.

Apparently, Floyd responded to the lien claiming that he did not have sufficient liquid money to cowl the debt. Just a few months later, Floyd’s lawyer filed paperwork assuring the IRS that their invoice could be paid in full quickly as a result of their shopper was about to have a “important liquidity occasion.” That occasion was his August 2017 combat towards Conor McGregor. The IRS had demanded to be paid instantly, to which Floyd’s authorized workforce replied:

“Though the taxpayer has substantial belongings, these belongings are restricted and primarily illiquid. The taxpayer has a major liquidity occasion scheduled in about 60 days from which he intends to pay the steadiness of the 2015 tax legal responsibility due and excellent.”

Again in 2020, 50 Cent (Floyd’s former BFF turned final hater) went on a radio present and claimed Floyd’s “cash was GONE”:

In 2022, Jake Paul claimed his brother Logan had not been paid for his or her ridiculous combat as a result of Floyd did not have the cash. Jake claimed, “Floyd is Broke man. I have been saying it the entire total time… I feel he spent [the money] paying all these ladies to be round him.“

The Non-public Jet and Mansion Gross sales

One other extremely seen image of Mayweather’s wealth addressed within the Enterprise Insider report is his main personal jet, the $60 million Gulfstream G650 dubbed “Air Mayweather.” In line with FAA data cited by the outlet, Mayweather bought the plane in late 2025. This sale adopted a interval wherein the jet had been used as collateral for high-interest loans and was the topic of liens from aviation gasoline suppliers and upkeep corporations over allegedly unpaid payments. Mayweather has since been seen touring in a secondary Gulfstream III (typically referred to as “Air Mayweather II”).

Enterprise Insider additionally highlighted a shift in Mayweather’s residential portfolio, suggesting that latest gross sales had been much less about “flipping for revenue” and extra about offloading debt:

Mayweather additionally bought or is within the technique of promoting a number of high-profile residential properties:

What Enterprise Insider’s Reporting Does — and Does not — Show

Lots of people on social media (Twitter primarily) have taken Enterprise Insider’s headline and confidently used it to proclaim that Floyd Mayweather is broke, bancrupt, or unable to satisfy his long-term monetary obligations. That is not true. It is necessary to separate liquidity points from internet value. Many ultra-wealthy people maintain the vast majority of their wealth in illiquid belongings reminiscent of actual property, personal companies, or long-term investments. Borrowing towards these belongings, even aggressively, doesn’t robotically point out monetary collapse.

The extra cheap takeaway will not be that Floyd’s fortune has vanished, however that his post-boxing monetary place could also be extra complicated, extra leveraged, and fewer bulletproof than the general public persona of “Cash Mayweather” suggests.

Floyd Mayweather’s story will not be distinctive amongst ultra-high-earning athletes. The transition from peak incomes years to retirement typically exposes structural weaknesses in money move, funding technique, and oversight. What makes Floyd’s case particularly compelling is the sheer scale of his success. Only a few athletes have ever earned over $1 billion. Fewer nonetheless tried to stay their very own boss, promoter, and chief decision-maker lengthy after the first income engine shut off.

For now, Floyd stays enormously rich, publicly defiant, and actively disputing Enterprise Insider’s portrayal of his funds. With a defamation lawsuit pending and several other monetary issues unresolved, this story is way from completed.