Introduction: Navigating the Future of Personal Finance

In today’s fast-paced digital world, managing personal finances has become more accessible and efficient, thanks to the rise of AI budgeting apps. Among the frontrunners in this space are Cleo and Rocket Money, each offering unique features tailored to different financial needs. As we step into 2025, understanding the strengths and weaknesses of these platforms is crucial for individuals aiming to take control of their financial future.

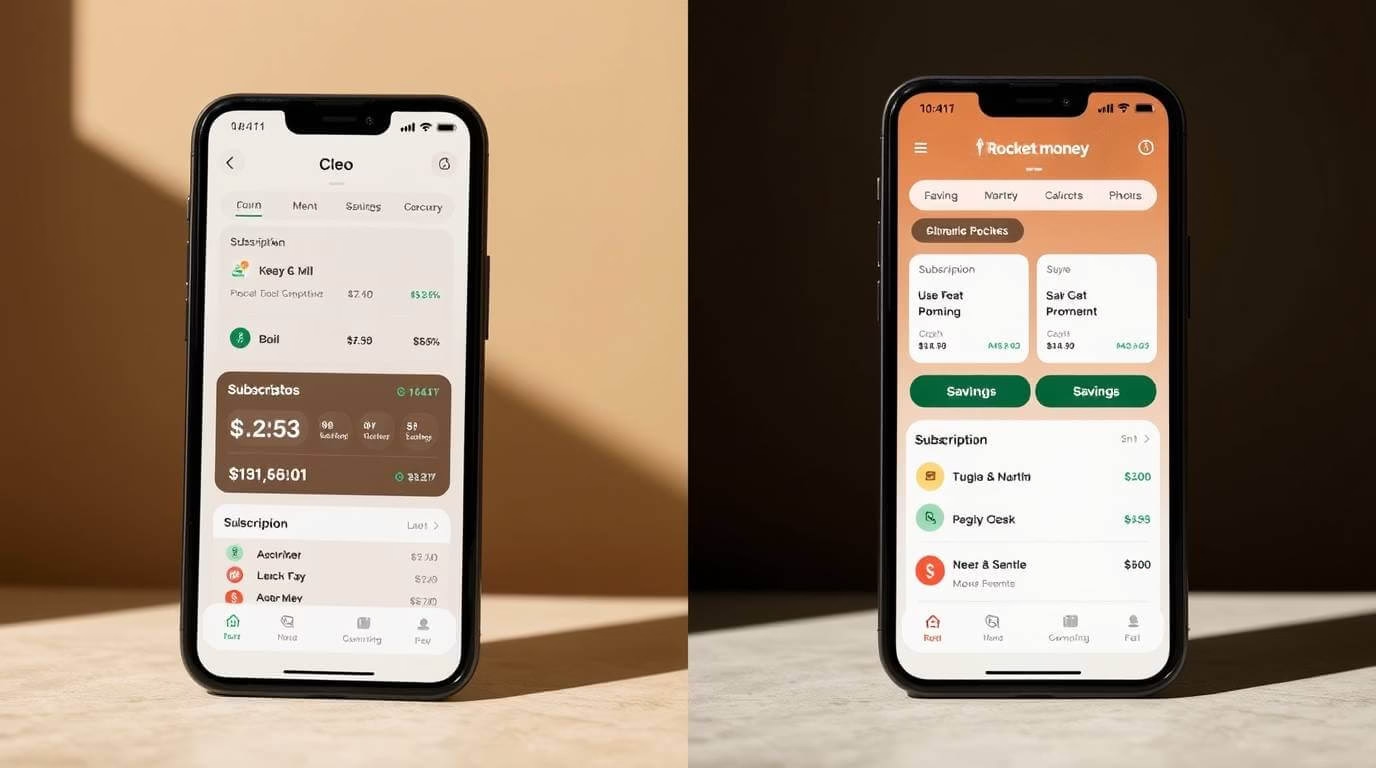

Cleo: The Chatbot Companion for Modern Budgeting

Cleo has carved a niche by combining financial management with a conversational AI interface. Designed to appeal to a younger demographic, Cleo offers a playful yet informative approach to budgeting.

Key Features of Cleo

Cash Advances: Eligible users can receive small cash advances during financial shortfalls

Conversational Interface: Interact with Cleo through a chat-based system that provides real-time financial insights.

Budgeting Tools: Set spending limits and track expenses across various categories.

Savings Assistance: Utilize features like “Save Hacks” to automate savings based on spending habits.

Credit Building: Access tools aimed at improving credit scores over time.

Pros and Cons of Cleo

Pros:

- Engaging and user-friendly interface.

- Offers a range of free features with optional premium upgrades.

- Provides personalized financial advice in a relatable manner.

Cons:

- May lack the depth of features desired by more advanced users.

- Premium features require a subscription fee.

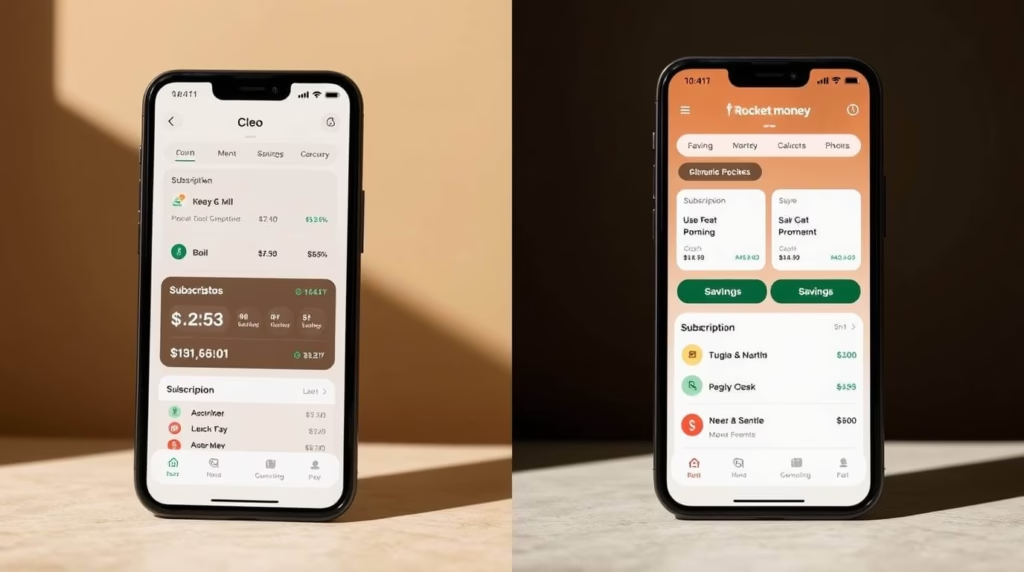

Rocket Money: Comprehensive Financial Oversight

Rocket Money, formerly known as Truebill, positions itself as a comprehensive financial management tool. Aimed at users seeking a more detailed overview of their finances, Rocket Money offers a suite of features designed to optimize budgeting and spending.

Key Features of Rocket Money

- Budgeting and Expense Tracking: Monitor spending habits and create customized budgets.

- Subscription Management: Identify and cancel unwanted subscriptions to reduce unnecessary expenses.

- Bill Negotiation: Leverage Rocket Money’s team to negotiate lower rates on bills like cable and internet.

- Credit Monitoring: Keep tabs on credit scores and receive alerts for significant changes.

- Savings Goals: Set and track progress toward specific financial objectives.

Pros and Cons of Rocket Money

Pros:

- Comprehensive financial tools suitable for various user needs.

- Automated features save time and effort in managing finances.

- Offers both free and premium plans to cater to different budgets.

Cons:

- Some features are locked behind a paywall.

- The interface may be overwhelming for users seeking simplicity.

Head-to-Head Comparison: Cleo vs. Rocket Money

| Feature | Cleo | Rocket Money |

|---|---|---|

| Interface | Chat-based, conversational | Dashboard with detailed analytics |

| Budgeting Tools | Basic budgeting with AI insights | Advanced budgeting and tracking |

| Savings Features | Automated savings via “Save Hacks” | Goal setting with progress tracking |

| Subscription Management | Not available | Identify and cancel subscriptions |

| Bill Negotiation | Not available | Available for various services |

| Credit Monitoring | Basic tools | Comprehensive monitoring |

| Cash Advances | Up to $250 for eligible users | Not available |

| Pricing | Free with optional $5.99/month Pro | Free with optional $4–$12/month Premium |

User Experience and Accessibility

Cleo’s intuitive chat interface makes it appealing to users who prefer a conversational approach to financial management. Its design is particularly attractive to younger users who are accustomed to messaging apps.

Rocket Money offers a more traditional dashboard experience, providing in-depth analytics and a comprehensive view of one’s financial health. This setup is beneficial for users who desire detailed insights and control over their finances.

Which AI Budgeting App Suits You Best?

- Choose Cleo if: You prefer a light-hearted, conversational approach to budgeting and are looking for basic tools to manage your finances.

- Choose Rocket Money if: You seek a comprehensive financial management system with advanced features like subscription management and bill negotiation.

Conclusion: Making the Right Choice for Your Financial Future

Both Cleo and Rocket Money offer valuable tools for managing personal finances, each catering to different user preferences and needs. By assessing your financial goals and desired level of engagement, you can select the AI budgeting app that aligns best with your lifestyle. Embrace the future of personal finance by choosing the tool that empowers you to take control of your financial journey.

Cleo AI: Smart Money Manager – App Store

Get personalized financial planning with our Free AI Budget Planner

What is an AI budgeting app?

An AI budgeting app uses artificial intelligence to analyze your spending habits, automate savings, track expenses, and provide personalized financial advice, making money management easier and smarter.

How does Cleo work as an AI budgeting app?

Cleo acts like a chatbot that interacts with you through messages, offering budgeting tips, spending insights, and even automated savings based on your cash flow, all in a fun and engaging way.

Can Rocket Money cancel my subscriptions automatically?

Yes, Rocket Money can detect recurring subscriptions linked to your accounts and help you cancel unwanted ones to save money automatically.

Which app is better for beginners: Cleo or Rocket Money?

Cleo is generally better for beginners due to its conversational interface and easy-to-understand advice, while Rocket Money suits users who want detailed financial control and automation.

Are these AI budgeting apps secure to use?

Both Cleo and Rocket Money use bank-level encryption and comply with industry security standards to ensure your financial data is protected.

Can I use Cleo and Rocket Money together?

Yes, you can use both apps simultaneously if you want to leverage Cleo’s chatbot experience and Rocket Money’s comprehensive financial tools together.