Within the mid-Nineteen Eighties, a person named Benjamin Sisti was using excessive.

Sisti was the founding father of a seemingly very profitable actual property firm known as Colonial Realty. Benjamin Sisti and Jonathan Googel co-founded Colonial Realty in 1966. By the late Nineteen Eighties, Colonial had ballooned into one of many largest actual property syndication corporations within the nation, controlling roughly $2 billion in property throughout 80 restricted partnerships, a lot of them in Connecticut.

A Mansion Is Born

As each a private reward and a really public method of celebrating his increasing fortunes, in 1985, Sisti accomplished building on a 52,000-square-foot mansion set on over 17 acres in Farmington, Connecticut, a brief drive from Colonial’s Hartford headquarters. He spent a reported $2.3 million developing the mansion, the fashionable equal of round $7 million. The property options a big non-public lake, tennis court docket, a 4-bedroom visitor home and and far more. The first dwelling has roughly 20 bedrooms and 40 bogs!

Sadly, behind the 52,000-square-foot facade, Sisti was working an enormous Ponzi-like fraud by Colonial. The corporate took in cash from traders whilst its funds collapsed, hid materials info, and funneled hundreds of thousands to kin to cover property from collectors. They even bribed public officers—together with the Mayor of Waterbury—to maintain pension cash flowing into their initiatives. An estimated 7,000 folks would come ahead as victims of the scheme, a few of whom claimed to have misplaced their life financial savings. It apparently nonetheless stands as the most important actual property fraud in Connecticut’s historical past.

In 1990, each Sisti and Colonial had been compelled to declare chapter. In his submitting, Sisti claimed to have simply $15,000 in money to his title. His beloved mansion slipped into foreclosures, and in 1992, it was acquired at public sale by the Folks’s Financial institution for $3.5 million. A yr later, Sisti took a plea deal. In 1995, he was sentenced to 9 years of federal jail.

Whereas all that was happening, in 1993, a Lithuanian businessman purchased the house from the financial institution for $2.7 million. Inside a yr, the Lithuanian was additionally reportedly going through chapter. He held off his collectors for the following few years earlier than promoting the property in early 1996 for $2.8 million. The customer in 1996 was Mike Tyson.

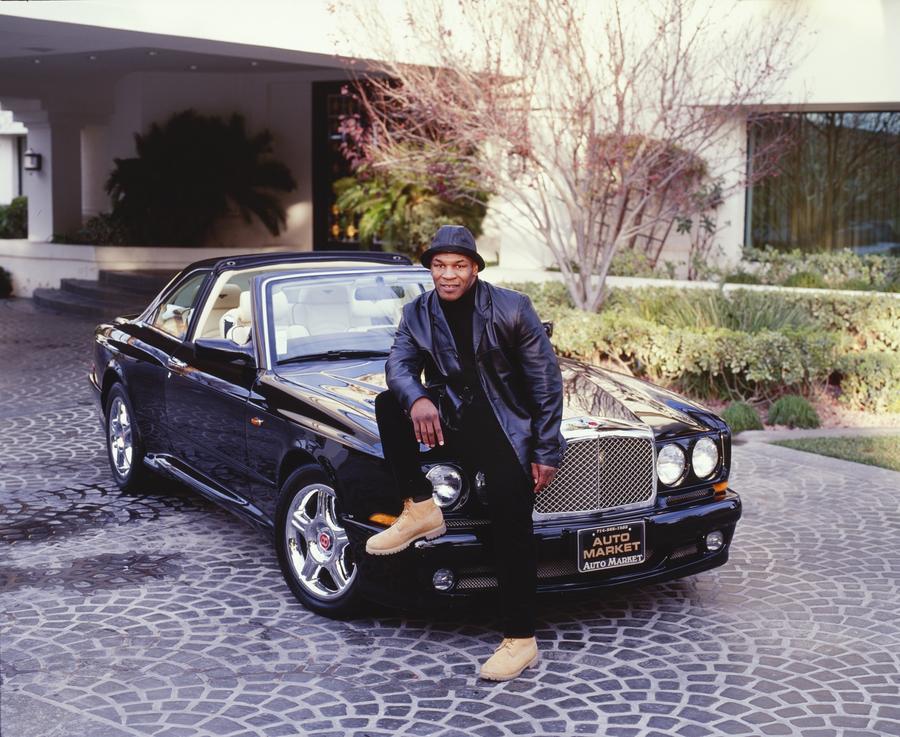

(Picture by Gregory Bojorquez/Getty Pictures)

The Mike Tyson Period

A yr earlier than the sale, Mike was sitting in a jail cell in Indiana. He had been convicted of rape in 1992 and was launched in March 1995.

Six months after his launch, Mike earned $25 million by practically murdering Peter McNeely within the ring in his extremely anticipated boxing comeback. Just a few months later, Mike purchased the Connecticut mansion.

Over the following two years, Mike earned $155 million from simply six fights. And as you would possibly count on, he poured a wholesome portion of these earnings into the Connecticut property, including a nightclub he known as “Membership TKO,” an indoor pool, a basketball court docket, and an indoor racquetball court docket.

Sadly, as you could know, Tyson’s funds finally imploded. In his first three years after being launched from jail, Mike spent the next quantities:

- $4.5 million on vehicles and motorbikes (19 autos he purchased for mates)

- $400,000 on pigeons and a wide range of huge cats, equivalent to Siberian tigers

- $300,000 on garden care and backyard upkeep alone

- $240,000 per 30 days for walking-around cash

- $230,000 on cell telephones, pagers, and cellphone payments

- $125,000 per yr for an animal coach to deal with the large cats

- $100,000 per 30 days on jewellery and garments

He purchased properties in Las Vegas, Ohio, and Maryland. He additionally, at one level, tried to promote the Connecticut mansion. He listed it in Might 1997 for $22 million, roughly $19 million greater than he paid a little bit over a yr earlier. He didn’t get any consumers at that value.

In August 2003, Mike declared Chapter 11 bankruptcy. In his submitting, he listed $5 million value of property and $27 million value of debt. That very same yr, he finalized his divorce from a girl named Monica Turner. Within the divorce, she acquired the Connecticut mansion.

Monica Turner virtually instantly offered the house for $4.1 million. The customer was…

50 Cent

Earlier in 2003, 50 Cent exploded onto the worldwide stage together with his smash-hit single “In Da Membership” and accompanying album “Get Wealthy or Die Making an attempt,” which might go on to promote 12 million copies worldwide. 50 proceeded to spend hundreds of thousands on upgrades that included including a movie show, pool grotto, and a helipad. In 2007, he gave a tour of the house for “MTV Cribs,” which I’ve embedded under.

I keep in mind this episode of Cribs so properly. I did not even have to rewatch it simply now. What stands out most in my thoughts is the purpose across the 13-minute mark when 50 confirmed off his automobile assortment. As you may see, along with a number of muscle vehicles, 50’s automobile assortment supposedly included:

- Ferrari F50

- Ferrari Enzo

- Ferrari 599

It was virtually too good. 50 Cent owned a mansion whose deal with is 50 Fashionable Hill Drive. That spanned 50,000 sq. toes. And one of many garages housed an F50…. or did it?

Through the years, it been alleged that fifty didn’t personal the Ferraris he confirmed throughout Cribs. I am a little bit of a Ferrari nut and spent a while down a rabbit gap of Ferrari boards attempting to resolve this controversy. Based on one thread, the vehicles had been owned by a neighbor, a rich collector whose initials had been apparently “SC.” If I had been a betting man, I’d wager that “SC” is Silas Chou. Silas and enterprise accomplice Lawrence Stroll earned their respective multi-billion-dollar net worths because the homeowners of vogue manufacturers equivalent to Tommy Hilfiger, Michael Kors, and Karl Lagerfeld. Silas and Lawrence each personal F50s (in addition to dozens of different Ferraris apiece). Additionally they co-own Aston Martin. Not an Aston Martin. Aston Martin, the corporate. However I digress. Level is, 50 in all probability did not personal these vehicles.

50’s Cash Troubles

50 Cent first tried to dump the Connecticut property in 2007 for $18.5 million with out success. He cycled the house on and off the marketplace for the following few years, usually asking $9,999,999. He did not get any consumers, and sadly, in July 2015, the property’s chapter curse struck once more!

50 Cent declared bankruptcy in July 2015, itemizing money owed of $36 million and property of $16 million. In subsequent authorized filings, 50 described the Connecticut dwelling as a monetary albatross costing him practically $70,000 each month only for upkeep and utilities. 50’s chapter plan finally included promoting the home. He lastly unloaded it in April 2019 for $2.9 million.

2019 – The Current

The customer in 2019 was a Florida businessman named Casey Askar. Askar apparently made his fortune proudly owning quick meals franchises, notably a number of Dunkin’ Donuts. The Askars simply listed the house on the market for $9.90 million. They don’t look like struggling any monetary issues, so (fingers crossed), hopefully, the chapter curse has been damaged. However all consumers ought to beware! This dwelling has a really lengthy and sordid monetary historical past.

Btw, the Askar household gave CNBC a tour of the house quickly after they purchased it: